Financial advisors are just like any other business when it comes to defining a brand; they need to express it well to communicate the right message to prospects and clients. It is one of the most crucial things an advisor can do to grow their business. Brand voice is extremely important, learn more about why that is below.

The 4 Elements of Brand Voice

The way that your brand is expressed through your marketing and advertising can be referred to as your brand voice. There are four important elements to consider when defining your brand voice.

Character

The character of a brand’s voice is the way that its voice is represented. It is the focal point of the brand’s relationship with its audience. A brand character can be more conceptual, or it can be embodied in an individual or spokesperson. For many financial advisors and other professional service providers, their brand character represents themselves. Because a service offering is so wrapped up in the character of the individual who executes it, it makes sense for an audience to interact directly with the advisor’s public persona.

Character is made up of two distinct elements: character appearance and character personality. The images and pictures advisors use in their marketing serve as the visual representation of their brand. Professional headshots, appropriate attire, and even friendly facial expression can go a long way to creating an inviting character.

Those who choose to let their company exist as an entity without using their own likeness as a representation face the same challenges as those who act as their own spokesperson. A logo can be imbued with as much personality as a picture of a human being. It is all about creating a clear set of attributes that can be expressed in the other elements of brand voice.

Purpose

Once a character is defined, it becomes crucial that an audience understands the goals and aims of that character. This is where a brand purpose comes in. Often a company will take time to establish its purpose through a mission statement that encapsulates a brand’s values, unique values, and primary benefits. This mission statement can then be used to inform the brand voice by providing editorial direction for topics that are important .

Communicating your purpose is the primary goal of your brand character. When a purpose is communicated clearly, it will act as a magnet attracting the ideal clients whose goals align with that purpose. Thus the goal of every new iteration of brand expression becomes expressing sense in some way or another.

Tone

In MailChimp’s brand guide, the company has this to say about tone:

“What’s the difference between voice and tone? Think of it this way: You have the same voice all the time, but your tone changes. You might use one tone when you’re out to dinner with your closest friends, and a different tone when you’re in a meeting with your boss.

The same is true for MailChimp. Our voice doesn’t change much from day to day, but our tone changes all the time.”

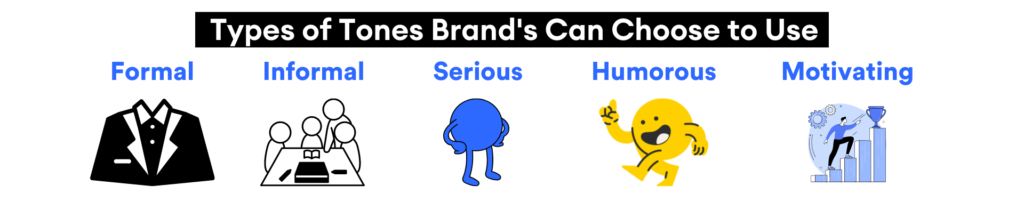

The tone is the situational expression of a brand. It can change from situation to situation and subject to subject, but it is always some version of the overall voice. The tone is expressed through the positions you take on different matters as well as the volume and insistence of your communication.

When considering tone, there are several situations in which a company can expect the need for communication to arise: the sales process, troubleshooting, apologies, and financial transactions. By determining the tone most appropriate for each situation a brand can begin to build out its tone from the collective sum of all the different tones used.

Language

A big part of brand voice is the language that it uses to express itself. It defines the purpose, illustrates the character, and makes up the tone already discussed. There are a lot of questions to answer when considering what type of language to use in your marketing. How these questions are answered is the process in which the rest of the brand voice elements are defined.

One aspect of a brand’s language is how formal it is. Financial advisors will often lean towards more formal language. This can be expressed with slightly longer and more complex sentences, the inclusion of more industry terms and buzzwords as well as longer more complex vocabulary.

While this can go a long way to establishing expertise, the risk of overly formal language is alienating an audience. It is harder to feel a personal connection with language meant to demonstrate knowledge. As with the other elements of brand voice, there is a tight wire act between presenting the polished persona and allowing the audience to connect with the more human side of the company.

When considering the voice of your brand, it is important to focus on each of the different elements and define the parameters in which a brand will operate. One powerful technique is to phrase things in a “we are, we are not” paradigm. By establishing the type of character, purpose, tone, and language their brand both will and will not be associated with a financial advisor can begin to put finite edges on its brand voice which can be a very elusive and difficult-to-communicate concept. It is worth spending time with this exercise as a cohesive voice will not only attract an advisor’s ideal clients but will also act as a catalyst for continued engagement with existing clients.

The All-in-One Marketing Tool

We make it easy to market effectively. Everything you need – website, email, social media, blogs, events, video and printed cards – all in one place.